The smart Trick of San Diego Home Insurance That Nobody is Discussing

The smart Trick of San Diego Home Insurance That Nobody is Discussing

Blog Article

Safeguard Your Home and Enjoyed Ones With Affordable Home Insurance Policy Program

Value of Affordable Home Insurance Policy

Protecting affordable home insurance policy is important for safeguarding one's home and financial wellness. Home insurance policy gives protection versus numerous threats such as fire, burglary, all-natural calamities, and personal liability. By having an extensive insurance coverage plan in position, property owners can rest ensured that their most significant investment is protected in the occasion of unpredicted circumstances.

Cost effective home insurance policy not just provides economic security yet additionally offers assurance (San Diego Home Insurance). Despite rising property worths and construction expenses, having an economical insurance plan makes sure that homeowners can conveniently restore or fix their homes without encountering significant economic concerns

In addition, affordable home insurance policy can additionally cover individual items within the home, supplying reimbursement for things damaged or stolen. This insurance coverage extends past the physical structure of your house, protecting the components that make a house a home.

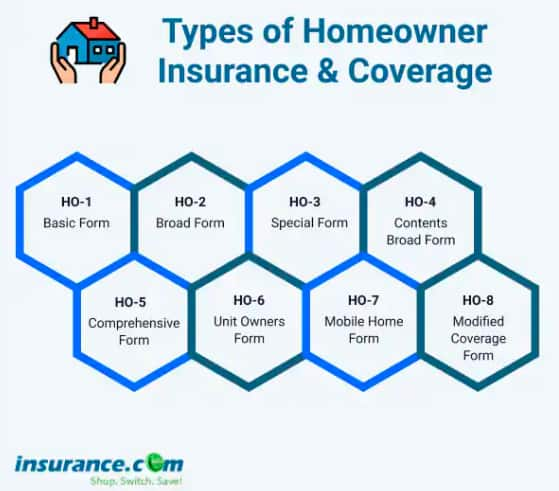

Insurance Coverage Options and Boundaries

When it comes to insurance coverage limits, it's important to recognize the optimum amount your policy will pay for each sort of protection. These restrictions can differ relying on the plan and insurance firm, so it's necessary to evaluate them carefully to ensure you have ample defense for your home and assets. By understanding the protection alternatives and restrictions of your home insurance coverage policy, you can make enlightened choices to protect your home and loved ones effectively.

Factors Influencing Insurance Policy Costs

Numerous variables dramatically affect the costs of home insurance coverage plans. The place of your home plays an important duty in determining the insurance coverage premium.

Moreover, the kind of insurance coverage you choose directly impacts the cost of your insurance plan. Selecting additional insurance coverage options such as flood insurance coverage or earthquake insurance coverage will certainly increase your premium. Choosing higher insurance coverage limitations will result in greater expenses. Your deductible quantity can additionally impact your insurance policy expenses. A greater insurance deductible generally indicates reduced premiums, but you will have to pay more expense in the event of an insurance claim.

In addition, your credit rating, declares history, and the insurance provider you select can all influence the price of your home insurance plan. By thinking about these variables, you can make educated choices to aid handle your insurance coverage costs efficiently.

Contrasting Companies and quotes

:max_bytes(150000):strip_icc()/dotdash-home-warranty-vs-home-insurance-5081270-Final-b2fa2539ff3c475296bae8529873651f.jpg)

Along with contrasting quotes, it is vital to assess the reputation important link and economic stability of the insurance policy carriers. Try to find client testimonials, scores from independent firms, and any kind of history of complaints or governing activities. A trusted insurance policy provider ought to have a good performance history of immediately refining insurance claims and offering outstanding customer support.

In addition, take into consideration the certain coverage features provided by each provider. Some insurance providers may provide fringe benefits such as identity burglary protection, equipment malfunction coverage, or coverage for high-value things. By very carefully comparing carriers and quotes, you can make a notified choice and choose the home insurance plan that best satisfies your demands.

Tips for Saving on Home Insurance Policy

After completely contrasting quotes and providers to find the most appropriate protection for your needs and spending plan, it is prudent to explore effective strategies for saving on home insurance policy. Many insurance business provide discounts if you acquire numerous policies from them, such as incorporating your home and car insurance coverage. Routinely evaluating and updating your policy to mirror any type of adjustments in your home or scenarios can guarantee you are not paying for protection you no longer need, aiding you save cash on your home insurance premiums.

Verdict

In final thought, Full Report protecting your home and loved ones with economical home insurance policy is vital. Implementing ideas for saving on home insurance coverage can also aid you safeguard the needed defense for your home without damaging the financial institution.

By unwinding the complexities of home insurance strategies and exploring practical techniques for protecting budget friendly coverage, you can make certain that your home and loved ones are well-protected.

Home insurance coverage policies generally offer numerous protection options to shield your home and belongings - San Diego Home Insurance. By understanding the protection options and limits of your home insurance coverage policy, you can make enlightened choices to safeguard your home and liked ones properly

Routinely examining and upgrading your plan to reflect any kind of modifications in your home or circumstances can guarantee you are not paying for coverage you no longer requirement, aiding you save cash on your home insurance policy premiums.

In conclusion, protecting your home and enjoyed ones with affordable home insurance policy is important.

Report this page